In 2024, JPMorgan Chase received nearly half a million applications for its summer analyst positions alone. Fewer than 1% of those applicants secured an offer. This isn’t just a job application; it’s a competition more selective than getting into Harvard.

The interview process at the world’s largest bank is designed to identify the absolute best. They test not only your technical skills but your resilience, commercial awareness, and cultural fit. Succeeding requires more than just a strong resume; it demands meticulous preparation and a deep understanding of what interviewers are truly looking for.

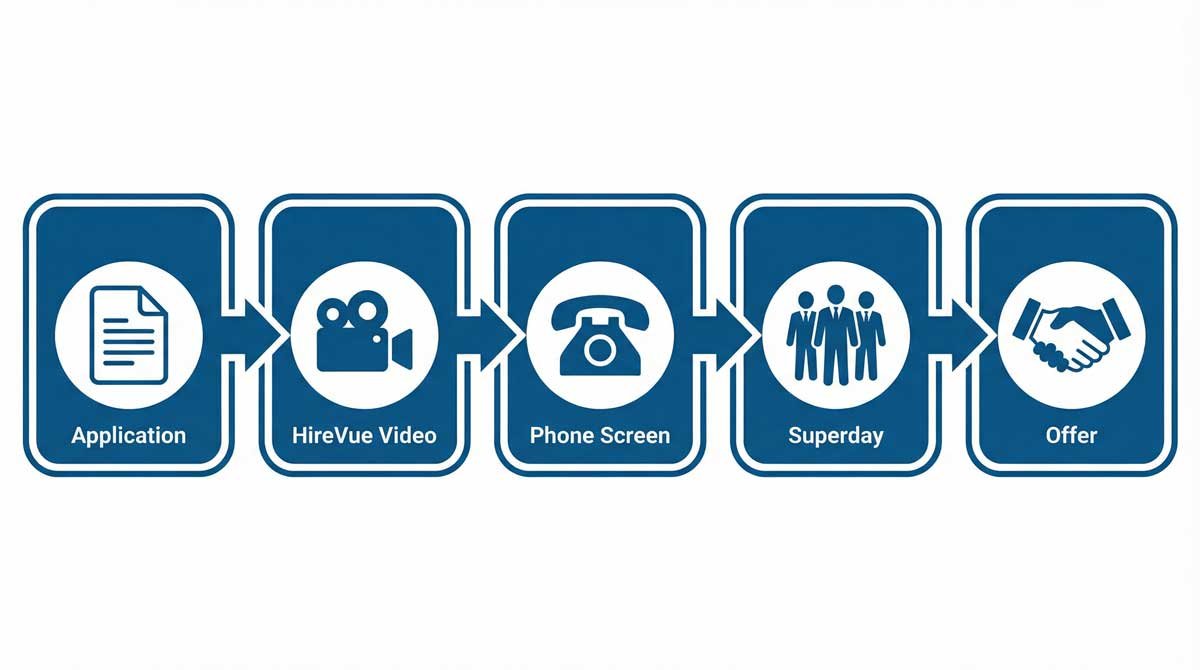

This guide cuts through the noise. We’ll dissect the entire interview process, from the initial application to the final Superday. You’ll get a curated list of the 35 most common JPMorgan Chase interview questions, complete with expert-crafted answers and the frameworks behind them. Forget generic advice—this is your comprehensive playbook for conquering one of the most challenging interviews in finance.

The Complete JPMorgan Chase Interview Process

Navigating the JPMorgan Chase interview process is like a multi-stage marathon. Each step is an elimination round, designed to filter candidates until only the most qualified remain. Understanding this timeline is the first step toward effective preparation.

Stage 1: The Online Application

This is your first hurdle. Your resume and cover letter are scanned by an Applicant Tracking System (ATS) before a human ever sees them. Tailor your resume with keywords from the job description to pass this initial screen. Recruiters look for relevant experience, quantifiable achievements, and a clear connection to the financial industry. Expect a response within one to two weeks if you make the cut.

Stage 2: The HireVue Video Interview

If your application impresses, you’ll receive an invitation for a HireVue interview. This is a pre-recorded video interview where you answer 3-5 behavioral questions. You’ll have a short time to prepare and a set time to record your answer for each question. Ensure your technical setup is flawless and practice delivering concise, confident answers directly to the camera. You typically have about a week to complete this after receiving the invitation.

Stage 3: The Phone or Virtual Screening

Candidates who pass the HireVue stage move on to a live screening, usually with a recruiter or a junior team member. This 20-30 minute call is a mix of resume review and behavioral questions. They are assessing your communication skills, motivation, and basic qualifications for the role. This typically occurs one to two weeks after your HireVue submission.

Stage 4: The Superday

The Superday is the final and most intense phase. It consists of 3-5 back-to-back interviews with a mix of analysts, associates, Vice Presidents (VPs), and sometimes Managing Directors (MDs). Questions will be a rapid-fire mix of behavioral, technical, and case-based scenarios. This is where they test your ability to think on your feet, handle pressure, and fit in with the team. Superdays are usually scheduled two to three weeks after the phone screen.

Stage 5: The Offer

If you conquer the Superday, you can expect an offer within one to two weeks. The offer will be communicated via a phone call from the recruiter or hiring manager, followed by a formal written offer. For entry-level roles, negotiation room is limited, but it’s always worth asking about relocation assistance or signing bonuses.

35 Most Common JPMorgan Chase Interview Questions (With Answers)

Based on a comprehensive analysis of thousands of interview experiences from Glassdoor, Reddit, and direct candidate reports, we’ve compiled the definitive list of JPMorgan Chase interview questions. They are organized by category to help you structure your preparation. For behavioral questions, we recommend using the STAR method (Situation, Task, Action, Result) to frame your answers.

Behavioral Interview Questions

1. Tell me about yourself.

This isn’t an invitation to recite your resume. It’s a test of your ability to present a concise, compelling narrative that connects your past experiences to this specific opportunity. Structure your answer like a 90-second elevator pitch: start with your current role, bridge to your key accomplishments, and end with why you are here, interviewing for this role at JPMorgan Chase.

Sample Answer: “I’m currently a final-year finance student at [Your University], where I’ve specialized in corporate finance and valuation. Over the past year, I’ve served as the portfolio manager for our student investment fund, where I led a team of five analysts to outperform our benchmark by 15% through a deep-dive analysis of undervalued tech stocks. That experience solidified my passion for the analytical rigor of finance and led me to pursue an opportunity at a firm known for its market leadership. I’m incredibly excited by JPMorgan’s role in major global deals and am eager to bring my analytical skills and collaborative mindset to your investment banking team.”

2. Why JPMorgan Chase?

Your answer must go beyond surface-level compliments. Interviewers want to see that you’ve done your homework and have a genuine, specific reason for wanting to join their team. Avoid generic answers like “it’s a top bank.” Instead, reference specific deals, company values, or recent initiatives that resonate with you.

Sample Answer: “I’m drawn to JPMorgan Chase for two primary reasons. First, your firm’s commitment to innovation, particularly the work being done with AI in asset management, directly aligns with my interest in the intersection of finance and technology. I was particularly impressed by the recent whitepaper on AI-driven portfolio optimization. Second, I’ve spoken with two current analysts, [Name 1] and [Name 2], who both emphasized the firm’s collaborative culture and the high level of responsibility given to junior bankers. That combination of cutting-edge work and a supportive, growth-oriented environment is exactly what I’m looking for in the next step of my career.”

3. Why do you want to work in [investment banking/technology/operations]?

This question assesses your understanding of the specific division you’re applying to. Your answer should demonstrate a clear passion for the field and a realistic understanding of the day-to-day work. Connect your skills and interests directly to the demands of the role.

4. Describe your most challenging team assignment.

Interviewers use this question to evaluate your teamwork, problem-solving, and resilience. Choose a story where you faced a significant obstacle, took specific actions to overcome it, and achieved a positive, quantifiable result. Focus on your individual contribution within the team context.

5. Tell me about a time you failed. What did you learn?

This is a test of your self-awareness and ability to learn from mistakes. Choose a real, but not catastrophic, failure. The key is to spend less time on the failure itself and more time on what you learned and how you applied that lesson to future situations. Show that you are coachable and have a growth mindset.

6. How do you handle pressure and tight deadlines?

The ability to perform under pressure is non-negotiable in finance. Provide a specific example of a high-stakes situation you successfully navigated. Describe your system for prioritization, time management, and maintaining accuracy under stress.

7. Describe a time you had to work with a difficult team member.

This question probes your interpersonal and conflict-resolution skills. Frame your answer professionally, without speaking negatively about the other person. Focus on the steps you took to understand their perspective, find common ground, and ensure the team’s objective was met.

8. Tell me about a time you showed leadership.

Leadership isn’t just about titles. Even as a junior candidate, you can demonstrate leadership by taking initiative, motivating others, or taking ownership of a project. Choose an example where you identified a problem and mobilized others to solve it.

9. What are your greatest strengths?

Choose three strengths that are highly relevant to the role and the culture at JPMorgan Chase. For each strength, provide a brief example that proves it. Think in terms of analytical ability, work ethic, communication skills, and attention to detail.

10. What is your biggest weakness?

The classic trick question. Choose a genuine weakness, but one that is not a fatal flaw for the role. Frame it in a way that shows self-awareness and a commitment to improvement. For example, you might mention a tendency to be overly detailed and then explain how you’re learning to balance perfectionism with efficiency.

Technical & Role-Specific Questions

11. What is financial risk?

For any finance role, this is a fundamental concept. Your answer should be clear and concise, covering market risk, credit risk, and operational risk. Give a brief example for each to demonstrate your understanding.

12. Walk me through a DCF model.

This is a classic investment banking question. Break it down into clear steps: 1) Project free cash flow for a period (usually 5-10 years). 2) Calculate the terminal value. 3) Discount the cash flows and terminal value back to the present using the Weighted Average Cost of Capital (WACC). 4) Sum the present values to get the enterprise value.

13. Explain the difference between equity and debt.

A simple but crucial question. Explain that debt is a loan that must be repaid with interest, while equity represents ownership in a company. Mention the difference in risk and return for investors.

14. What programming languages are you proficient in? (for tech roles)

Be honest about your proficiency level. It’s better to be an expert in one or two languages (like Python or Java) than to claim familiarity with many. Mention specific projects where you’ve used these languages.

15. Describe your experience with [specific technology/tool]. (for tech roles)

Provide a specific example of a project where you used the technology in question. Explain the problem you were solving, how you used the tool, and the outcome of the project.

16. How would you explain a complex financial product to a client?

This tests your communication and simplification skills. Use an analogy or a simple, step-by-step explanation. The goal is to show you can make complex topics accessible without being patronizing.

17. What are the three financial statements and how are they connected?

Name the Income Statement, Balance Sheet, and Cash Flow Statement. Explain that Net Income from the Income Statement links to the Balance Sheet and Cash Flow Statement. The Cash Flow Statement’s beginning cash balance comes from the prior period’s Balance Sheet, and its ending cash balance becomes the current period’s cash on the Balance Sheet.

18. Describe a recent project where you used data analysis.

Use the STAR method to describe a project where you used data to drive a decision. Mention the tools you used (Excel, Python, SQL, etc.), the insights you generated, and the impact of your analysis.

Market Awareness & Commercial Questions

19. Tell me about a recent financial article you’ve read.

Choose an article from a reputable source (Wall Street Journal, Financial Times, Bloomberg). Summarize the key points and, most importantly, offer your own opinion on its implications for JPMorgan or the industry.

20. What challenges will JPMorgan face in the next 5-10 years?

This tests your strategic thinking. Mention challenges like competition from fintech, regulatory changes, cybersecurity threats, and macroeconomic uncertainty. Offer a balanced perspective.

21. How are the markets performing today?

Know the current levels of major indices (S&P 500, Dow Jones), the 10-year Treasury yield, and a recent major economic news story. This is a basic test of your market awareness.

22. What do you know about JPMorgan’s recent deals/initiatives?

Research a recent major deal or initiative from the division you’re applying to. Speak about it intelligently, showing you understand its strategic rationale.

23. How would you describe JPMorgan’s business model?

Explain the main divisions: Corporate & Investment Bank (CIB), Asset & Wealth Management (AWM), Commercial Banking (CB), and Consumer & Community Banking (CCB). Show you understand how they work together.

24. What are JPMorgan’s Business Principles?

Memorize and be ready to discuss a few of them, such as “Exceptional Client Service” or “Operational Excellence.” Connect them to your own work ethic.

25. What’s your view on [current economic issue]?

Have an informed opinion on a current topic like inflation, interest rates, or a major geopolitical event. Show that you can analyze its potential impact on the financial markets.

Situational & Problem-Solving Questions

26. How would you handle a situation where you disagree with your manager?

Emphasize a respectful, data-driven approach. Explain that you would first seek to understand their perspective, then present your own viewpoint with supporting evidence, and ultimately respect their final decision.

27. If you overheard a colleague speaking inappropriately to a client, what would you do?

This is an ethics question. The correct answer involves escalating the issue to your manager or compliance department. Do not confront the colleague directly in the moment, but do not ignore the situation.

28. How do you prioritize multiple projects with competing deadlines?

Describe a system, such as a to-do list or a prioritization matrix (e.g., Eisenhower Matrix). Mention the importance of clear communication with stakeholders to manage expectations.

29. What would you do if you made a mistake on an important client deliverable?

The key here is accountability. The right answer is to immediately inform your manager, take ownership of the mistake, and come prepared with a plan to fix it.

30. How would you approach a project with unclear requirements?

Show that you are proactive. Explain that you would schedule a meeting with the project stakeholders to ask clarifying questions, document the requirements, and get sign-off before starting the work.

Closing & Cultural Fit Questions

31. Why should we hire you?

This is your final sales pitch. Summarize your top three strengths and connect them directly to the needs of the role and the company. End with a confident statement about the value you will bring to the team.

32. Where do you see yourself in five years?

Show ambition, but also loyalty. A good answer involves growing with the firm, taking on more responsibility, and potentially mentoring junior team members. Be realistic but aspirational.

33. What are your salary expectations?

For entry-level roles, it’s best to deflect this question by saying you expect a competitive salary for the role and location. If pressed, provide a well-researched range based on industry data.

34. How do you align with JPMorgan’s values?

Pick two or three of JPMorgan’s core values (e.g., Integrity, Teamwork, Excellence) and provide a brief example from your own experience that demonstrates each one.

35. Do you have any questions for us?

Always have 3-5 thoughtful questions prepared. Ask about the team culture, the biggest challenges for a new hire, or what success looks like in the role. This shows your genuine interest.

How to Prepare for Different JPMorgan Roles

While the core behavioral questions are consistent, the technical and case-based questions vary significantly by role. Tailoring your preparation to the specific division is critical.

Investment Banking Analyst/Associate

This is one of the most competitive tracks. You need to demonstrate a strong work ethic, financial modeling skills, and market knowledge. Expect deep dives into accounting, valuation, and M&A concepts. Be prepared for case studies where you might have to analyze a company and make a recommendation.

Technology/Software Engineer

The focus here is on technical proficiency. You’ll face coding challenges on platforms like HackerRank, focusing on data structures and algorithms. Be prepared to discuss your past projects in detail, explaining your design choices and the technologies you used. Knowledge of financial markets is a plus, but coding skill is paramount.

Operations/Risk Management

These roles require a process-oriented mindset and strong analytical skills. Interviewers will test your ability to identify inefficiencies, manage risk, and solve complex logistical problems. Knowledge of regulatory frameworks and a keen eye for detail are essential.

Sales & Trading

This fast-paced environment demands quick thinking, quantitative skills, and a strong personality. Be prepared for brain teasers, mental math problems, and questions about your market views. They are looking for candidates who are confident, articulate, and can handle high-pressure situations.

Corporate Functions (HR, Marketing, Finance)

For these roles, you need to demonstrate a deep understanding of JPMorgan’s business and how your function supports it. Be prepared to discuss your past experience in the context of a large, complex organization and how you can add value to the firm’s overall strategy.

10 Insider Tips to Ace Your JPMorgan Interview

Beyond just answering questions, there are several things you can do to stand out from the competition.

1. Research Beyond the Basics

Go deeper than the company website. Read JPMorgan’s latest quarterly report. Understand the challenges and opportunities facing the specific division you’re applying to. Mentioning a specific detail from a recent earnings call will impress your interviewers.

2. Master the STAR Method, But Don’t Sound Robotic

Practice telling your stories using the STAR method until they are second nature. This will ensure your answers are structured and impactful. However, deliver them in a natural, conversational way. You want to tell a story, not recite a script.

3. Prepare Questions That Show Genuine Interest

The questions you ask are just as important as the ones you answer. Avoid generic questions about salary or benefits. Instead, ask about the team’s recent successes, the biggest challenges a new hire will face, or the interviewer’s own career path at the firm.

4. Dress the Part

Even for a virtual interview, dress in full business professional attire. It shows respect for the process and the firm’s culture. First impressions are powerful, and your appearance is a key part of that.

5. Practice with Mock Interviews

There is no substitute for live practice. Ask a friend, career services advisor, or a professional coach to conduct a mock interview with you. Record yourself to identify and correct any verbal tics or awkward body language.

6. Know Your Resume Inside and Out

Every single bullet point on your resume is fair game. Be prepared to discuss any experience in detail, providing specific examples and quantifiable results. Your interviewers will probe for depth, so be ready for it.

7. Demonstrate Cultural Fit

JPMorgan has a distinct culture built on teamwork, integrity, and a relentless drive for excellence. Weave these themes into your answers. Show that you are not just a skilled candidate, but a future colleague who will thrive in their environment.

8. Stay Current with Financial News

Read the Wall Street Journal, the Financial Times, and Bloomberg every day in the weeks leading up to your interview. Have an informed opinion on major market trends and be able to discuss them intelligently.

9. Follow Up Appropriately

Send a personalized thank-you email to each of your interviewers within 24 hours. Reference a specific point from your conversation to make it memorable. This small gesture reinforces your interest and professionalism.

10. Be Authentic

While preparation is crucial, don’t let it strip away your personality. Interviewers want to hire people they would enjoy working with. Let your genuine enthusiasm for the role and the firm shine through.

7 Common Mistakes to Avoid

- Being too generic in your “Why JPMorgan” answer. It shows a lack of genuine interest.

- Not preparing thoughtful questions to ask. This can be interpreted as a lack of curiosity or engagement.

- Speaking negatively about past employers or colleagues. It reflects poorly on your professionalism.

- Failing to quantify your achievements. Numbers are more impactful than words.

- Not researching your interviewers on LinkedIn. Understanding their background can help you build rapport.

- Appearing either desperate or arrogant. Confidence is key, but it must be balanced with humility.

- Neglecting technical preparation for non-technical roles. Even in behavioral interviews, a basic understanding of finance is expected.

What Sets Successful JPMorgan Candidates Apart

JPMorgan doesn’t just hire for skill; they hire for a specific mindset. Successful candidates demonstrate a unique blend of technical prowess, commercial acumen, and cultural alignment. Here’s what they look for:

Core Competencies

- Analytical Thinking: The ability to break down complex problems and make data-driven decisions.

- Communication Skills: The clarity and confidence to articulate complex ideas to clients and colleagues.

- Teamwork: A collaborative spirit and the ability to thrive in a high-pressure team environment.

- Leadership Potential: The initiative to take ownership and influence others, regardless of title.

- Commercial Awareness: A deep understanding of the business, the markets, and how JPMorgan fits into the global landscape.

- Resilience: The mental fortitude to handle pressure, setbacks, and long hours.

The “JPMorgan Mindset”

Beyond these competencies, there is a certain mindset that defines a successful JPMorgan employee. It’s a relentless focus on the client, an obsession with detail, and an unwavering commitment to ethical standards. They look for individuals who are not just looking for a job, but are passionate about building a long-term career and contributing to the firm’s legacy.

Real Success Stories

Consider the candidate who, when asked about a recent deal, not only described the transaction but also analyzed its impact on the competitive landscape and suggested a follow-up opportunity. Or the technology candidate who, in a behavioral interview, related their coding project back to improving client experience. These are the candidates who connect their skills to the firm’s ultimate mission: serving clients.

JPMorgan Chase Salary Ranges & Post-Interview Process

Understanding compensation and the post-interview timeline can help manage your expectations. While specific numbers vary by location and market conditions, here are some typical ranges for 2026.

Typical Salary Ranges by Role

| Role | Base Salary Range | Bonus | Total Comp |

|---|---|---|---|

| Analyst (IB) | $100,000 – $110,000 | $50,000 – $70,000 | $150,000 – $180,000 |

| Associate (IB) | $175,000 – $200,000 | $75,000 – $125,000 | $250,000 – $325,000 |

| Software Engineer (Entry) | $95,000 – $120,000 | $10,000 – $25,000 | $105,000 – $145,000 |

| Operations Analyst | $65,000 – $85,000 | $5,000 – $15,000 | $70,000 – $100,000 |

After the Interview

The wait after the final round can be nerve-wracking. Typically, you can expect to hear back within one to two weeks. If you don’t hear anything after two weeks, a polite follow-up email to the recruiter is appropriate. Offers are usually extended via a phone call, followed by a formal written contract.

Onboarding & First 90 Days

Once you accept an offer, you’ll go through an extensive onboarding and training program. The first 90 days are a steep learning curve. You’ll be expected to absorb a massive amount of information, build relationships with your team, and start contributing to projects quickly. JPMorgan invests heavily in its junior talent, providing mentorship and continuous learning opportunities to help you succeed.

Frequently Asked Questions About JPMorgan Chase Interviews

- 1. How hard is it to get hired at JPMorgan Chase?

- It is extremely competitive. For some roles, like summer investment banking analyst, the acceptance rate is less than 1%. This makes it one of the most selective employers in the world. However, with the right preparation, it is achievable.

- 2. How long does the JPMorgan interview process take?

- The entire process, from application to offer, typically takes between 4 to 8 weeks. The timeline can vary depending on the role and time of year.

- 3. What is the JPMorgan HireVue interview like?

- The HireVue interview is a pre-recorded video interview where you answer 3-5 behavioral questions. You will have about 30 seconds to prepare for each question and 2-3 minutes to record your answer. It is used as an initial screening tool.

- 4. Can I reapply if I’m rejected?

- Yes, you can typically reapply for other positions or for the same position in the next recruiting cycle, which is usually 6-12 months later.

- 5. Do I need an Ivy League degree to work at JPMorgan?

- No. While JPMorgan recruits heavily from top universities, they are increasingly focused on hiring talent from a diverse range of schools and backgrounds. Your skills, experience, and interview performance are more important than the name on your diploma.

- 6. What should I wear to a virtual JPMorgan interview?

- Treat it like an in-person interview. Wear a full business professional suit. It shows respect for the process and the firm’s culture.

- 7. How many people typically interview on a Superday?

- A Superday usually involves 3-5 back-to-back interviews with different members of the team, ranging from analysts to senior leaders.

- 8. What’s the best way to prepare for technical questions?

- For finance roles, use resources like the Breaking into Wall Street (BIWS) 400 Questions guide. For tech roles, practice coding problems on LeetCode and HackerRank. Regardless of the role, know your resume and past projects inside and out.

- 9. Should I send a thank you email after each interview round?

- Yes. Send a personalized thank-you email to each interviewer within 24 hours. It’s a professional courtesy that reinforces your interest.

- 10. What if I don’t know the answer to a technical question?

- Don’t panic and don’t try to bluff. Be honest that you don’t know the answer, but try to talk through how you would approach finding a solution. This shows your problem-solving skills and intellectual honesty.

- 11. Does JPMorgan sponsor work visas?

- Yes, JPMorgan does sponsor work visas for certain roles and candidates, but this is determined on a case-by-case basis. It is best to discuss this with your recruiter early in the process.

- 12. What’s the difference between JPMorgan and JP Morgan Chase?

- JPMorgan Chase & Co. is the parent company. “JPMorgan” typically refers to the investment banking and asset management divisions, while “Chase” refers to the consumer and commercial banking business.

Final Thoughts: Your Path to JPMorgan Chase Success

Landing an offer from JPMorgan Chase is a formidable challenge, but it is far from impossible. The single most important factor that separates successful candidates from the rest is the quality of their preparation. By understanding the interview process, mastering your stories, and doing a deep dive into the firm’s business and culture, you can walk into your interview with the confidence to excel.

Remember that less than 1% make it, but someone has to. The interviewers are not just looking for the smartest person in the room; they are looking for a future colleague who is resilient, collaborative, and genuinely passionate about finance. Let that passion show.

Use this guide as your roadmap. Practice relentlessly, prepare thoughtfully, and on the day of the interview, trust in the work you’ve done. Your journey to one of the most prestigious firms in the world starts now. Good luck.